Get Verified Ready™ in four simple steps.

Step 1

Secure Upload & Authorization

Buyers authorize access to employment, income, asset, soft credit, and insurance estimate data.

Step 2

AI-Assisted Review

Our system analyzes the data and confirms buyers understand their projected financial obligations.

Step 3

Verified Ready™ Certificate Issued

Buyers receive a shareable digital Verified Ready™ Certificate that remains valid for 60 days.

Step 4

Fast & Easy Updates

Buyers can update and maintain their Verified Ready™ status throughout their home search.

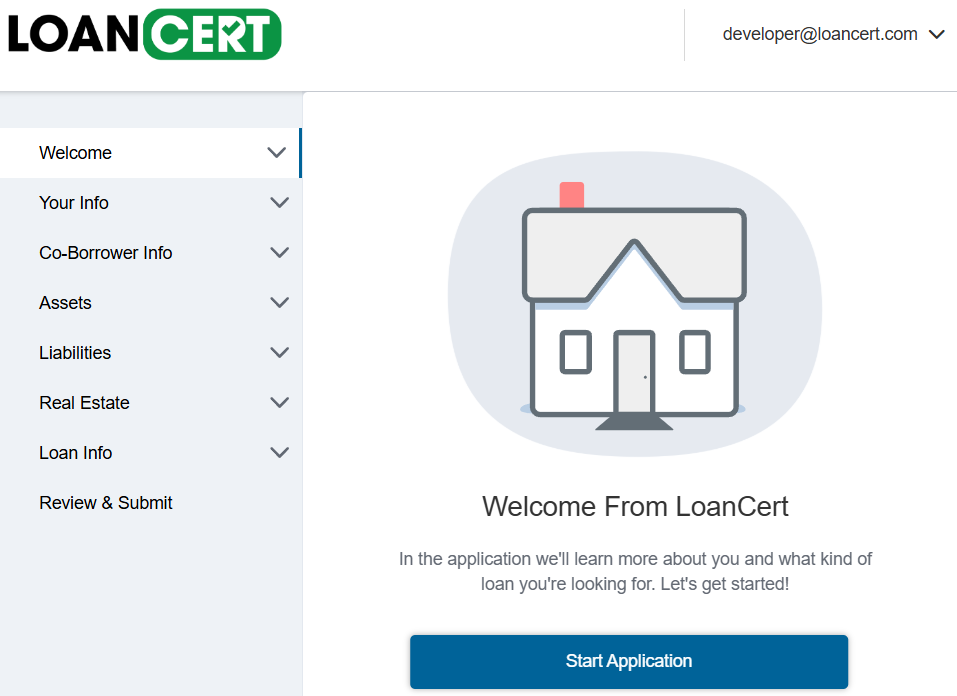

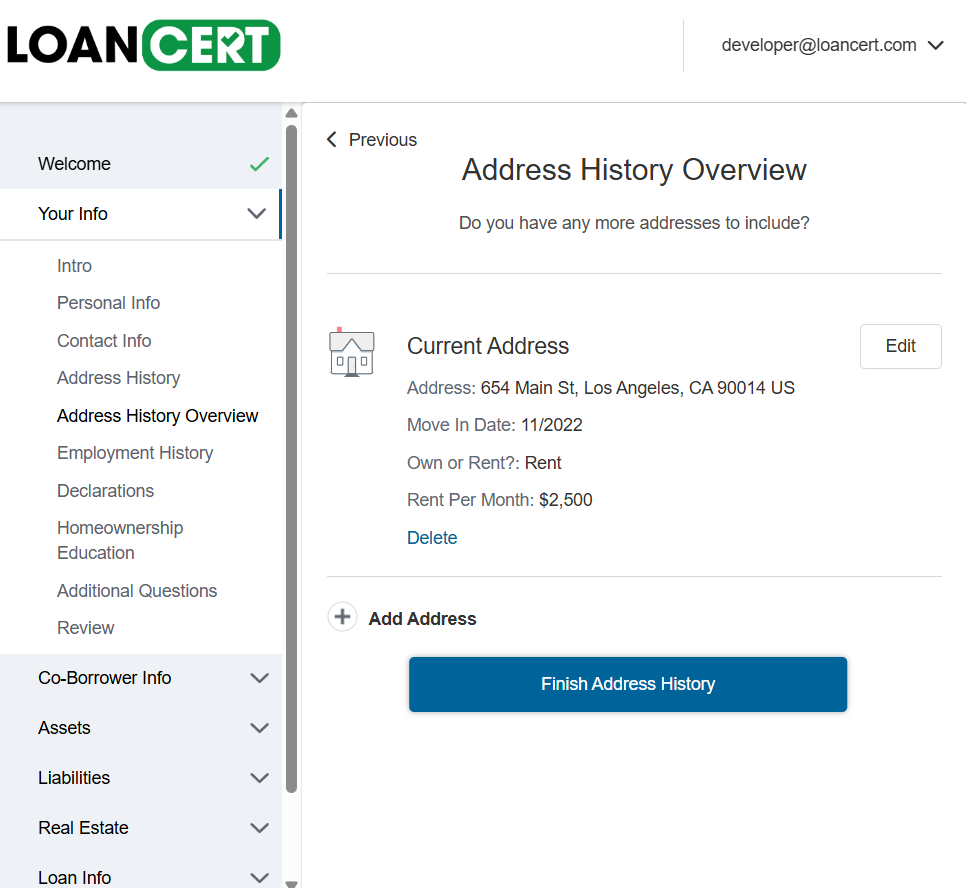

Take a Peek at the Process.

Why LoanCert™ Exists: The Hidden Numbers Behind Deal Fallout

Buying or selling a home is stressful enough. What most people don’t see is how often deals collapse, how inconsistent traditional pre-approvals are, and how much uncertainty Realtors® and sellers quietly swallow.

Here are the real numbers:

15% of accepted offers fall apart before closing.

Financing issues cause 28% of those failures.

42% of sellers fear the buyer won’t actually qualify, even with a pre-approval in hand.

80% of all buyers use financing, not cash, meaning reliability matters more than ever.

Sellers receive 2–4 offers on average, and they’re choosing the most reliable, not just the highest.

Nearly 1 in 4 pre-approved buyers still fail underwriting, slowing transactions and costing everyone time.

67% of Realtors® say pre-approvals are inconsistent, depending on the lender and how deeply they review.

When a deal falls apart, sellers lose 3–5 weeks, agents lose income, and buyers lose leverage.

LoanCert™ is here to take that stress away and get you and your family one step closer to your dream home.

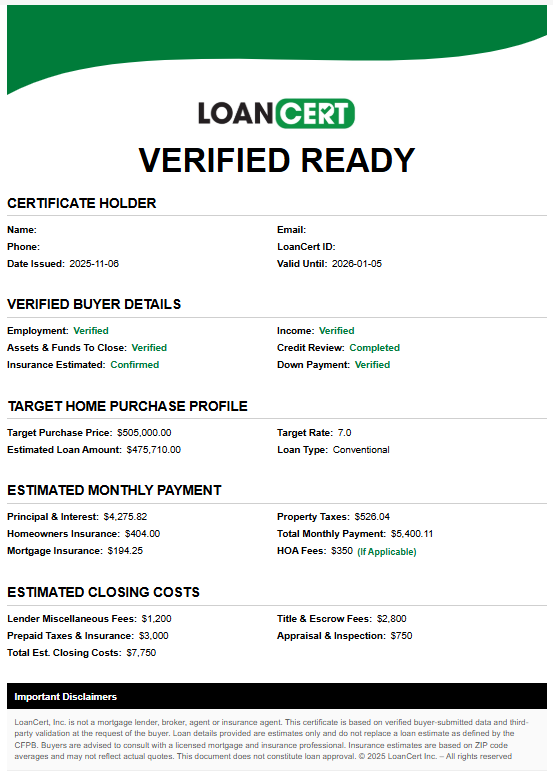

The Verified Ready™ Certificate

A trusted, easy-to-read certification showing:

The buyer’s verified financial readiness

Their understanding of their projected loan terms

Their acknowledgment of their estimated payment and insurance

Their acknowledgment of funds needed to close

A 60-day validity period with simplified renewal

Realtors® and sellers use it to separate prepared buyers from unprepared ones, without interfering with who the buyer chooses as their lender.

LoanCert™ Fixes the Exact Problems That Kill Deals

LoanCert™ does what traditional pre-approvals don’t:

Verifies income, assets, credit, employment, and insurance affordability

Identifies gaps before offers are written

Produces a uniform, objective Buyer Certification sellers trust

Gives listing agents confidence and improves offer acceptance

Reduces fallout, reduces fear, and increases speed

Helps financed buyers compete and win in a cash-heavy environment

In a competitive market where reliability matters more than ever, LoanCert™ gives buyers, sellers, and Realtors® an advantage.

Confidence Starts Here™.

FAQ

-

LoanCert™ is a first-of-its-kind platform that independently verifies a homebuyer’s financial readiness — not just their credit or pre-approval — to give sellers and agents greater confidence in closing.

We combine verified data, advanced AI analysis, and real-world underwriting logic to certify that a buyer is Verified Ready™ to purchase a home.

Unlike a lender pre-approval letter, which reflects one lender’s internal criteria, a LoanCert™ Verified Ready™ Certificate is an unbiased readiness validation designed to protect buyers, sellers, and Realtors® from the costly fallout that happens when transactions fail to close.

-

No. LoanCert™ is not a lender, broker, or financial advisor.

We do not make or arrange loans. We analyze verified financial and insurance data to help buyers, sellers, and Realtors® understand readiness and risk.

If you decide to pursue a loan, you’ll work directly with a licensed lender or mortgage professional.

-

Because a significant share of home purchase contracts fail before closing — for example, recent data shows that around 14.3% of U.S. homes under contract failed to close in one recent period.

When you factor in inspection issues, financing fall-throughs, insurance and cost surprises, the risk to sellers and agents is real.

LoanCert™ bridges that gap — verifying income, assets, credit, and insurance affordability upfront so all parties know where the buyer truly stands.

-

LoanCert™ uses proprietary data logic and integrations that go beyond a simple pre-approval. Our verification system includes:

AI-driven validation of borrower data: uses verified employment, income, and asset APIs, similar to lender-grade systems.

Insurance readiness review: incorporates estimated homeowners insurance premiums by ZIP code and risk profile — a major hidden cost that affects qualification.

Down payment & closing cost validation: confirms the buyer understands and can document required funds to close.

Buyer education acknowledgment: certifies the buyer has reviewed loan structure, payment expectations, and coverage requirements.

Together, these elements form the LoanCert™ Verified Ready™ Certificate, valid for 60 days, giving realtors and sellers assurance of a well-prepared buyer.

-

LoanCert™ is designed with two levels of service for buyers and partners, Premium and Premium Plus. Visit our pricing page for more details.

-

Your Verified Ready™ Certificate is your official proof of readiness. It’s valid for 60 days and confirms that:

Your credit, income, and assets meet standard purchase-readiness metrics.

You’ve reviewed and acknowledged your expected monthly payment, down payment, and insurance costs.

Sellers and Realtors® can rely on your readiness when evaluating offers.

-

The Buyer Companion™ is your interactive guide — powered by AI — that helps you understand your financial position, track your readiness level, and plan your next steps.

It’s like having a personal assistant that speaks the language of home buying, helping you stay confident, informed, and loan-ready.

-

Fewer fallouts: Verified Ready™ buyers are statistically more likely to close successfully.

Faster escrows: Buyers with full verification shorten the timeline to close by several days.

Stronger offers: Sellers see clear evidence that the buyer understands their total funds needed, including insurance and closing costs.

Neutral verification: Because LoanCert™ is not a lender, the certification has no hidden bias or competing financial agenda.

-

Your Verified Ready™ Certificate is valid for 60 days.

Because financial information can change, we recommend renewing every 60 days or sooner if:

Your income, debt, or assets change.

You’ve entered a new contract or are actively shopping for homes.

-

LoanCert™ works independently but may integrate with your Realtor® or lender’s process for faster validation.

You are always free to choose any lender, realtor, or insurance provider you prefer.

-

Yes. LoanCert™ uses bank-grade encryption and AWS cloud infrastructure to securely process all verification data.

We never sell or share your personal financial data without your explicit consent.

-

For a limited time, LoanCert™ Premium is offered FREE while we expand in California.

Future pricing tiers will be announced as Premium Plus and Seller Guarantee features launch, check our pricing page for updates.

-

LoanCert™ currently supports buyers and realtors in California only, with national rollout planned for 2026.

-

No. LoanCert™ does not provide specific loan or investment advice.

You should always consult a licensed mortgage professional or financial advisor for personalized guidance.

-

Realtors®, brokers, and affiliates can access co-branded materials, referral tracking, and early access to Premium Plus features.

Learn more on our Realtors® Program page.